Solving your Tax Needs For Years

Our Tax Experts will help you reach Peace of Mind.

ABOUT US

At Noble Tax Preparation, we are more than just tax consultants; we are your partners on your path to financial success. With a passion for helping individuals and businesses achieve their financial goals, we have built a reputation for excellence in the industry.

Our team of experienced advisors brings a diverse range of skills and knowledge to the table, allowing us to tailor tax strategies that fit your unique needs.

OUR SERVICES

Individual Tax Preparation

Noble Tax Preparation works to find the legal tax strategies in the Internal Revenue Tax Code that will reduce your personal income tax liability.

We want to make sure you get the most out of your state returns and federal tax returns to keep more money in your pocket.

Reduce Your Tax Liability

We work closely with our clients to learn everything we can about their financial puzzle. Our professional team of tax experts strictly adheres to state and federal tax laws while finding every legal tax deduction possible to reduce your liability.

Tax Resolution Services

Abundant Returns helps people just like you regain their financial independence and resolve problems ranging from delinquent tax debt to offers of installment agreements. We’ll handle the heavy lifting so you can focus on your business and personal well-being.

The longer you wait to act, the more IRS tax liability problems will stack up and become more severe.

Bookkeeping & Accounting Services

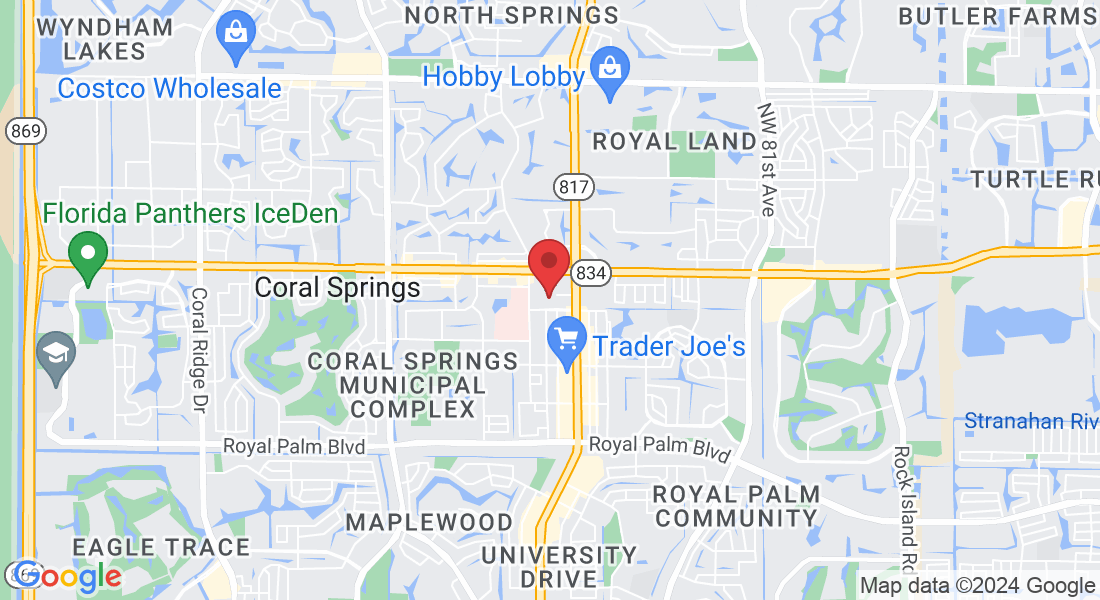

We provide small business accounting services in Broward County and the surrounding area. Small business owners save time and money by outsourcing their day to day bookkeeping and accounting needs to our professional bookkeepers and certified accountants.

Testimonials

I was feeling overwhelmed by my finances, but [financial consultant's name] helped me create a plan that was easy to follow and understand.

JAKE CARTER

I've been working with [financial consultant's name] for several years now, and he/she has helped me achieve some major financial goals.

MATTHEW JOHNSON

FAQS

How can I reduce my tax bill?

The tax code provides several ways to control your tax bill through deductions and credits. Tax deductions allow you to reduce your taxable income, and tax credits allow you to directly reduce your tax liability.

When you make income from a job, you can often reduce your taxable income by contributing to an employer-sponsored retirement plan or your own individual retirement account (IRA). You may also have a high deductible health plan through your employer with access to a health savings account (HSA) or flexible spending account (FSA).

What kind of deductions do I qualify for?

Almost everyone qualifies for the standard deduction or itemized deductions that reduce your taxable income. These are often the largest deductions available to you. Refer to item 6 below for information on which one might be best for you.

Self-employed workers and business owners may have more opportunities to save on their tax bills, but employees still have plenty of savings opportunities available. As an employee, you can deduct contributions made to IRAs, HSAs and FSAs when preparing your Form 1040.

Which is better: a tax credit or a tax deduction?

All things being equal, a tax credit is often preferable to a tax deduction. Tax credits reduce your tax liability dollar for dollar while tax deductions lower your taxable income. For example, if you prepare your taxes and have a total tax bill of $10,000, a $1,000 tax credit would reduce your bill by that amount.

If you had a $1,000 tax deduction and earned $50,000 in taxable income, your income tax liability wouldn't decrease by $1,000. Instead, your taxable income would now be $49,000. Depending on your tax bracket, that means you would save anywhere from $0 to $370 as compared to $1,000 from a tax credit.

OUR TEAM

Darren Clark

Samantha Waters

Lawrence Jones